ICSE Revision Notes for Commercial Mathematics Class 10 Maths

Chapter Name | Commercial Mathematics |

Topics Covered |

|

Related Study |

Recurring Deposit Account

Banks provide four different types of accounts, which are as follows:

- Savings Bank Account

- Current Bank Account

- Fixed Deposit Account

- Recurring (or cumulative) Deposit Account

Now, let us study about Recurring Deposit Account.

- To encourage the habit of saving among low and middle income groups, banks and post offices provide Recurring Time Deposit schemes.

- Under this scheme, an investor deposits a fixed amount every month for a fixed time period. This fixed time period is called maturity period.

- After completing the maturity period, the investor gets the amount deposited with the interest. The total amount received by the investor is called maturity value.

- In this scheme, the interest is compounded quarterly at a fixed rate. The rate of interest is revised from time to time.

Now, let us solve some more examples to understand the concept better.

Example 1: Suresh has a Recurring Deposit Account in a bank. He deposits Rs 1000 per month for one year. At the time of maturity, he gets Rs 12650. What is the rate of simple interest?

Answer

It is given that:

Money deposited per month, p = Rs 1000

Maturity period, n = 12 months

We know that,

S.I. = p × n(n + 1)/(2 × 12) × r/100

⇒ S.I. = 1000 × (12 × 13)/(2 × 12) × r/100

⇒ S.I. = 65r

It is given that:

Amount of maturity = 12650

p × n + S.I. = 12650

⇒ 1000 × 12 + 65r = 12650

⇒ 65r = 12650 − 12000

⇒ 65r = 650

⇒ r = 65065 = 10r = 65065 = 10

Thus, the rate of interest is =10% per annum.

Example 2: Abhishek has a Recurring Deposit Account in a bank for 2 years at 10% p.a. simple interest. If he gets Rs 3750 as the interest after maturity period, then find the monthly installment and the amount of maturity.

Answer

Let the monthly installment be Rs x.

It is given that r = 10%

n = (2 × 12) months = 24 months

We know that,

S.I. = p × n(n + 1)/(2 × 12) × r/100

⇒ 3750 = x × (24 × 25)/(2 × 12) × 10/100

⇒ x = (3750 × 10)/25

⇒ x = 1500

∴ Monthly installment = Rs 1500

Amount of maturity = p×n + S.I.

= 1500 × 24 + 3750

= 39750

Thus, the monthly installment is Rs 1500 and amount of maturity is Rs 39,750.

Shares and Dividends

Let us now learn some terms related to shares.

- Nominal Value (N.V) − The original value of a share is called the nominal value (N.V). It is also called registered value, printed value, or face value (F.V).

- Market Value (M.V) − The price of a share at a particular time is called market value (M.V). This market value changes from time to time.

- Share at par − If the market value and the nominal value of a share are equal, then the share is called a share at par.

Share at par: Market Value (M.V) = Nominal Value (N.V)

Example: If a share of Rs 100 is being sold at a price of Rs 100, then the share is called at par.

Share at premium − If the market value (M.V) of a share is more than the face value (F. V) of the share, then the share is called share at premium or above par. Share at a premium: Market Value (M.V) > Nominal Value (N.V)

Example: If a share of Rs 100 is being sold at a price of Rs 165, then it is called share at a premium of Rs 65 or share at Rs 65 above par.

Share at discount − If the market value of a share is less than the face value of the share, then it is called the share at discount or below par.

Share at a premium: Market Value (M.V) < Nominal Value (N.V)

Example: If a share of Rs 100 is being sold out for Rs 90, then the share is called at a discount of Rs 10 or at Rs 10 below par.

At the end of the year, when Mr. XYZ gets the profit, he decides to distribute the profit among the shareholders in proportion of their investments. This profit is called the dividend.

Dividend is always calculated as the percentage of the face value of the share. Therefore, dividend is the profit of the shareholders from their investments in the company.

Now, let us solve some examples to understand the

Example 1: Rajesh invests Rs 6500 in shares, which pay 8% dividend when a share of Rs 100 costs Rs 120. What is the annual income of Rajesh from shares?

Answer

Face value of the share = Rs 100

Market value of the share = Rs 120

Income from Rs 120 = 8% of Rs 100 = Rs 8

Income from Rs 6500 = Rs (8 × 6500)/120

= Rs 433.33

Thus, the income of Rajesh from shares is Rs 433.33.

Example 2: A man purchases some shares of a company, which pays 12% dividend at a time when a Rs 45 share costs Rs 50. What is his annual income from the shares, if he invests Rs 3100? Also, find the rate of interest, which he gets on the investment.

Answer

Money invested = Rs 3100

Market value of a share = Rs 50

∴ Number of shares = Rs 3100/Rs 50 = 62

Dividend on 1 share of Rs 45 = 12% of Rs 45

= 12/100 × 45

= Rs 5.4

Dividend on 62 shares = 62 × Rs 5.4

= Rs 334.8

∴ Annual income = Rs 334.8

Rate of interest = 334.8/3100 × 100%

= 10.8%

Example 3: Mayank and Basant purchase equal number of shares. Mayank purchases 5% Rs 50 shares at Rs 55 and Basant purchases 8% Rs 10 shares at Rs 12. Who earns more profit?

Answer

Mayank’s income on Rs 55 = 5% of Rs 50

= 5/100 × Rs 50

= Rs 2.5

Mayank’s income on Re 1 = Rs 2.5/55

= 0.045

Basant’s income on Rs 12 = 8% of Rs 10

= 8/100 × Rs 10

= Rs 0.8

Basant’s income on Re 1 = Rs 0.8/12

= Rs 0.066

Thus, Basant earns more profit than Mayank.

Example 4: Rashid sold 300 (Rs 20) shares paying 5% at Rs 25 and invested the proceeds in (Rs 12) shares at Rs 15. The rate of dividend is 8% per annum. What was the change in annual income of Rashid?

Answer

Selling price of 300 shares = 300 × Rs 25 = Rs 7500

Number of shares purchased = Rs 7500/Rs 15

= 500

Dividend on one share of Rs 20 = 5% of Rs 20

= Re 1

Dividend on 300 shares of Rs 20 = Rs 300

Income on Rs 20 shares = Rs 300

Dividend on 1 share of Rs 12 = 8% of Rs 12

= 8/100 × 12

= Rs 0.96

Dividend on 500 shares of Rs 12 = Rs 480

Income on Rs 12 shares = Rs 480

Change in income = Rs 480 − Rs 300

= Rs 180

Thus, the change in the annual income of Rashid is Rs 180.

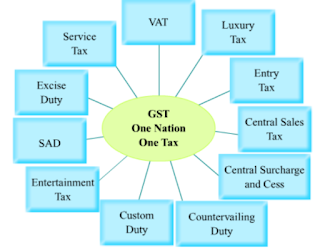

Goods and Services Tax (GST)

GST is a comprehensive indirect tax which replaced all the indirect taxes that were earlier levied by the central and the state governments. All the taxes like VAT, Service tax, Excise Duty, Custom Duty, etc, are now subsumed under GST. However, petroleum products and alcohol for human consumption is taxed separately by the individual state governments. So, GST is one indirect tax for the whole nation. It was launched all over India with effect from 1st July 2017.

Components of GST:

GST is levied under three categories:

- Central Goods and Service Tax (CGST): Collected by the central government on an intra-state sale.

- State Goods and Service Tax (SGST) or Union Territory GST (UTGST): Collected by the state/union territory government on an intra-state sale.

- Integrated Goods and Service Tax (IGST): Collected by the central government on an inter-state sale.

To understand this better, suppose that the seller and the purchaser both are located in same state, then both CGST and SGST/UTGST will be levied.

So, if rate of GST is 18%, then 9% will be levied as CGST and 9% as SGST/UTGST. Now, if the seller is located in Mumbai and the purchaser is in Chennai, then IGST will be levied.

Tax Invoice:

Let us understand tax invoice with the help of an example.

- The first two digits represent the state code. Every state has a unique code. For example: State code of Karnataka is 29 and that of Delhi is 07.

- The next ten digits will be the PAN number of the taxpayer.

- The thirteenth digit will be assigned based on the number of registration within a state.

- The fourteenth digit will be Z by default.

- The last digit will be for check code. It may be an alphabet or a number.

HSN Code: The Harmonized Commodity Description and Coding System generally refers to “Harmonized System of Nomenclature” or simply “HSN”.

- If a company has turnover up to ₹1.5 Crore in the preceding financial year then they need not mention the HSN code while supplying goods on invoices.

- If a company has turnover more than ₹1.5 Crore but up to ₹5 Cr then they need to mention the 2 digit HSN code while supplying goods on invoices.

- If turnover crosses ₹5 Cr then they shall mention the 4 digit HSN code on invoices. Similarly, in service invoice there will be SAC i.e.,"Service Accounting Code".

- In the invoice above, it can be seen that GST rate for cream is 5% and that for butter is 12%, which means that there are different GST rates for different commodities or services.

- The government has categorised items in five major slabs - 0%, 5%, 12%, 18% and 28%.

Here, is the list of some items or services under various GST slabs.

|

S. No. |

Slab |

Goods and Services |

|

1 |

0% |

Goods-Essential Commodities like food grains, Vegetables, milk, salt, earthen pots etc. Services – Hotels and lodges with tariff below Rs 1,000, agriculture related services, Education and Health care services etc. |

|

2 |

5% |

Goods-footwear below Rs 500, cream, skimmed milk powder, branded paneer, frozen vegetables, coffee, tea, spices, LPG cylinder etc. Services – All restaurants, transport services, Textile job work etc. |

|

3 |

12% |

Goods – Mobile phone, umbrella, sewing machine, ketchup & sauces, butter, cheese, ghee, dry fruits in packaged form etc. Services – State-run lotteries, Non-AC hotels, business class air ticket, fertilisers, Work contracts etc. |

|

4 |

18% |

Goods – Computer monitors, CCTV, Marble, Granite, Perfumes, Metal items, Printer etc. Services – Courier services, Outdoor catering, Circus, Drama, Cinema, Exhibitions, Currency exchange, Broker Services in share trading etc. |

|

5 |

28% |

Goods – Luxury items, Motor Cycles and spare parts, Luxury cars, Pan-masala, Vaccum cleaner, Dish washer, AC, Washing machine, Fridge, Tobacco products, Aerated water etc. Services – Five star Hotel accommodation Amusement parks, Water parks, Theme parks, Casino, Race course, IPL games, Air transport (business class) etc. |

Note: For more information, refer www.cbec.gov.in (Central Board of Excise & Customs).

Now, let us solve some examples to understand the concept better.

Example 1: A retailer purchases an article from a manufacturer for ₹ 1,000. The rate of GST is 12%. What is the amount of CGST and SGST in the tax invoice? What is the total amount paid by the retailer?

Answer

Here, rate of GST = 12%.

Therefore, rate of CGST = 6% and rate of SGST = 6%

Amount of CGST = 1000 × 6100 = ₹ 601000 × 6100 = ₹ 60

Amount of SGST = 1000 × 6100 = ₹ 601000 × 6100 = ₹ 60

Total amount paid by the retailer = Cost of article + CGST + SGST

= ₹ 1,000 + ₹ 60 + ₹ 60

= ₹ 1,120

Example 2: A retailer sells a washing machine to a customer at 20% discount on the list price. If the customer paid ₹ 15,360 and the amount of CGST is ₹ 1,680. Then, what is the list price of the washing machine and how much GST rate levied on this washing machine?

Answer

Here, the amount of CGST = ₹ 1,680

Then, the amount of SGST = ₹ 1,680

Total GST paid = ₹ 1,680 + ₹ 1,680

= ₹ 3,360

Taxable amount = ₹ 15,360 - ₹ 3,360

= ₹ 12,000

Total GST of ₹ 3,360 is paid on ₹ 12,000. So,

Rate of GST levied = (3360 × 100)/12000

= 28%

As retailer gave a discount of 20% on the list price.

∴ List price = (12000 × 100)/80

= ₹ 15,000.

Therefore, the list price of the washing machine is ₹ 15,000 and GST rate levied on this

machine is 28%.

Mechanism of GST:

Let us understand how GST works from manufacture to customer.

The mechanism of input credit under GST:

Input credit means reducing the taxes paid on input from taxes to be paid on output. The tax paid at the time of purchase is called 'Input tax' and the tax collected at the time of sale is called 'Output tax'.

When a trader pays GST to the government, he deducts the input tax from the output tax and pays the remaining tax.

Payable GST = Output tax − Input tax credit

From the above figure, it can be clearly seen that the manufacturer collects 'Output tax' from the distributor.

The distributor pays 'Input tax' to the manufacturer and collects 'Output tax' from the retailer.

Similarly, the retailer pays 'Input tax' to the distributor and collects 'Output tax' from the consumer.

Let us understand through an example how the trading chain of GST works.

Example: A manufacturer has sold one cellphone for ₹ 10,000 to the wholesaler. The wholesaler sold that cellphone for ₹ 12,000 to the retailer. Retailer sold it to the customer for ₹ 14,000. Rate of GST charged at every stage is 12%. Then how each trader pays GST and takes his input tax credit (ITC) at every stage of transaction is shown in the following flow-chart. Observe and study it.

Now, let us solve some examples to understand the concept better.

Example 1: A wholesaler paid GST of ₹ 500 at the time of purchase of an item. He collected GST of ₹ 650 when he sold the item.

(i) Find his input tax and output tax.

(ii) Find his payable GST.

(iii) Find the payable CGST and payable SGST.

Answer

(i) He paid GST of ₹ 500 at the time of purchase. So,

Input tax = ₹ 500

He collected GST of ₹ 650 at the time of sale. So,

Output tax = ₹ 650

(ii) Payable GST = ₹ 650 - ₹ 500 = ₹ 150

(iii) Payable CGST = Payable SGST

= ₹ 150/2

= ₹ 75

Example 2: Kirti Electricals purchased an air conditioner having taxable value ₹ 18,000 and sold it to the customer for the taxable value ₹ 25,000. Rate of GST is 28%. Find the GST paid by Kirti Electricals to the government.

Answer

Input tax (GST paid by Kirti Electricals) = ₹ 18000 × 28/100

= ₹ 5040.

Output tax (GST collected by Kirti Electricals) = ₹ 25000 × 28/100

= ₹ 7000.

Therefore, payable GST by Kirti Electricals

= ₹ 7000 - ₹ 5040

= ₹ 1960.